property tax assistance program california

The interest rate for all taxes postponed under the PTP program is 5 percent per year. The Senior Citizens Homeowners and Renters Property Tax Assistance Law program provided a direct grant to qualifying seniors and disabled individuals who owned or rented a residence.

Applying For The California Property Tax Welfare Exemption An Overview Nonprofit Law Blog

Property Tax Relief for Military Personnel.

. Single threshold circuit breakersthe same percentage of the breaker is applied to all low-income homeowners equally. Mortgage Relief Program is Giving 3708 Back to Homeowners. BOE forms that pertain to.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Property Tax Assistance Program. The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are.

Mortgage Relief Program is Giving 3708 Back to Homeowners. The chief programs in California which are implemented by county assessors. Check Your Eligibility Today.

Check If You Qualify For 3708 StimuIus Check. Formal Issue Paper 21-002 Property Tax Deadlines Impacted by COVID-19. Arizona - Homestead exemptions and property tax assistance programs are offered to honorably discharged service members soldiers sailors nurse corps and other veterans.

Investing in diverse communities with financing programs that help more Californians have a place to call home. Candidates should apply for the program every year. Down Payment Assistance Program Details.

Under this program taxes would be paid by the State and the deferred payment would create a lien on the property. Property must be a one- to three. Formal Issue Paper 21-001 Property Tax Deadlines Impacted by COVID-19 Pandemic.

State Controller Betty T. Property owners can choose to pay 0 full deferral 25 50 or 75 of the delinquent and future property taxes. If you are blind disabled or 62 years of age or older and on limited income you may be eligible for one of the following programs.

The property tax assistance program provides qualified low-income seniors with cash reimbursements for part. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Property Tax Postponement Program.

BOE forms that pertain to State Assessments. What is Property Tax Assistance. Obtain forms from either the County Assessor or the Clerk of the Board in the county where the property is located.

This is a program that is sponsored by the state of California to help people that are at least 63 years old blind or disabled when it comes to property taxes. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. There are two types of threshold circuit breakers.

Senior Citizen Property Tax Assistance. The California Mortgage Relief. September 15 2016.

Volunteer Income Tax Assistance VITA if you. Due to the large volume of referrals applications will be processed. Up to 25 cash back California also offers various forms of property tax assistance to certain homeowners.

The California Mortgage Relief Program will soon expand to include assistance with past due property taxes for all eligible homeowners. If you live in California you can get free tax help from these programs. Update from the State of California Controllers Office On September 28.

SCO administers the Property Tax Postponement PTP Program which. California has three senior citizen property tax relief programs. Third Party Property Tax Notification Program.

Our program opens on June 1 and applications must be submitted by Dec. And parcel that identifies each piece of real property for. Check Your Eligibility Today.

Property Tax Postponement Program The State Controllers Property Tax Postponement Program returned in 2016 after being suspended by the Legislature in 2009. The exemption applies to a portion of the assessed amount the first 34000. Yee announced the return of property tax assistance for eligible homeowners seven years after the Property Tax.

Property owner must be 65 or older. Ad 2022 Latest Homeowners Relief Program. Interest on postponed property taxes is computed monthly on a simple interest basis.

Make 58000 or less generally.

Secured Property Taxes Treasurer Tax Collector

Senior Citizen Property Tax Assistance Treasurer And Tax Collector

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Deducting Property Taxes H R Block

Payment Activity Notice Los Angeles County Property Tax Portal

What Is A Homestead Exemption California Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Notice Of Delinquency Los Angeles County Property Tax Portal

Ci 121 Montana S Big Property Tax Initiative Explained

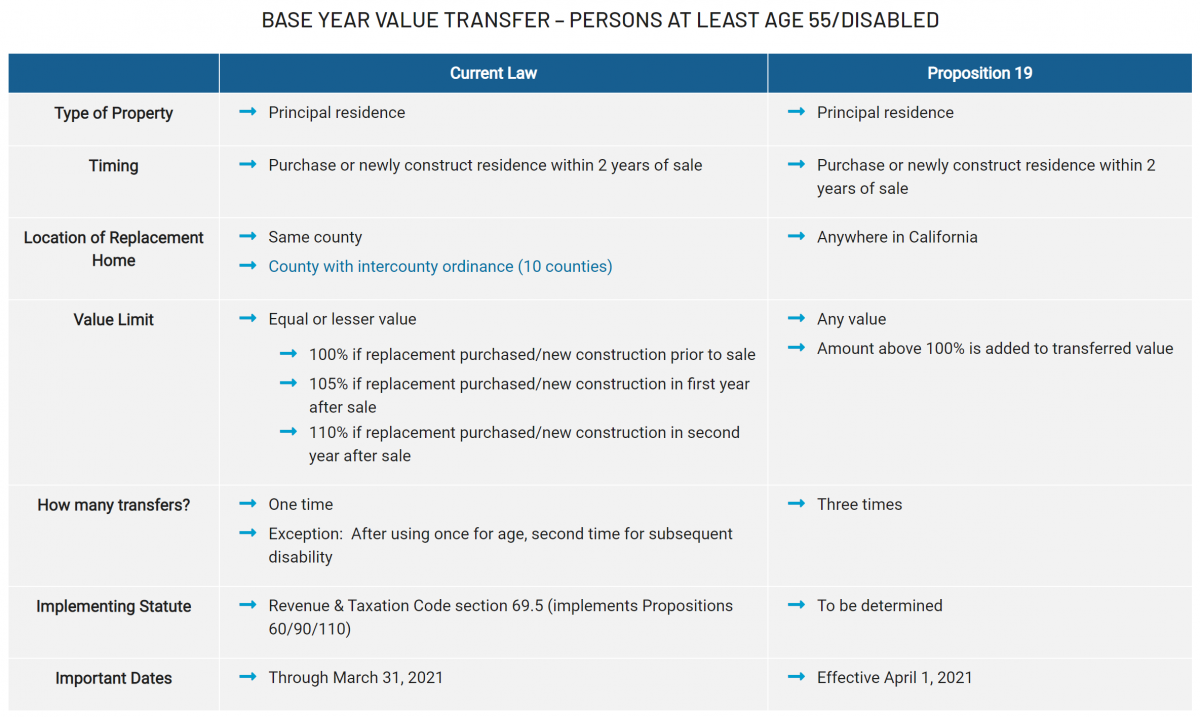

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Secured Property Taxes Tax Collector

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Property Taxes By State Embrace Higher Property Taxes

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

L A County Urged To Quickly Process Tax Relief Claims Los Angeles Times

Property Tax California H R Block

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire